VT Markets MT5

Introduction

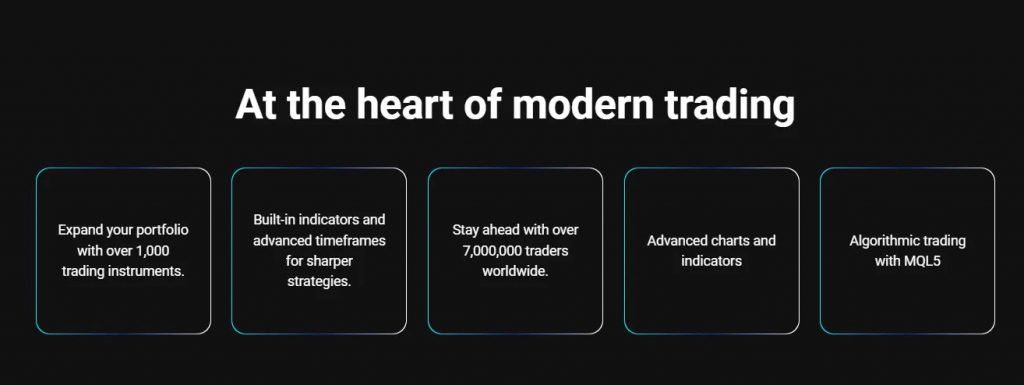

The VT Markets MT5 platform is the broker’s next-generation trading terminal, intended for traders seeking a broader asset class range, deeper analytics, and enhanced automation. It expands on the functionality of its MT4 counterpart, delivering more features and greater control. This article is a detailed exploration of the platform based on official information from vtmarkets.com, with direct insights on structure, toolset, and execution logic.

Platform Access and Installation

Accessing MT5 is a straightforward process. Traders can use it across multiple operating systems and devices, with no loss of functionality. Platform Access Options| Device/OS | Method of Access | Special Notes |

| Windows | Executable via client portal | Full charting and automation |

| macOS | VT Markets custom installer | No native MetaQuotes build |

| Linux | Supported via Wine | Manual installation required |

| iOS / Android | MT5 app via app store | Push notifications, trading on the go |

| Browser | WebTrader via portal login | No install, moderate charting support |

Instruments and Asset Class Access

One of the platform’s strongest advantages is the wide selection of trading instruments. VT Markets MT5 offers more than 1,000 products across different markets:

- Major, minor, and exotic forex pairs

- Index CFDs (e.g., US500, NAS100, GER40)

- Commodities including gold, silver, oil

- CFD shares like AAPL, TSLA, AMZN

- ETFs and bond CFDs

- Cryptocurrencies such as BTC/USD, ETH/USD

Asset Class Breakdown

| Market Type | Examples | Execution Type |

| Forex | EUR/USD, AUD/CAD | STP/ECN |

| Indices | GER40, HK50, NAS100 | CFD |

| Commodities | XAU/USD, Brent, WTI | CFD |

| Stocks | AAPL, TSLA, MSFT | CFD (non-ownership) |

| Crypto | BTC/USD, ETH/USD | CFD |

| ETFs & Bonds | SPY, US Treasuries | CFD |

This range allows for diversified strategies within a single account, which is a growing expectation among traders in Southeast Asia.

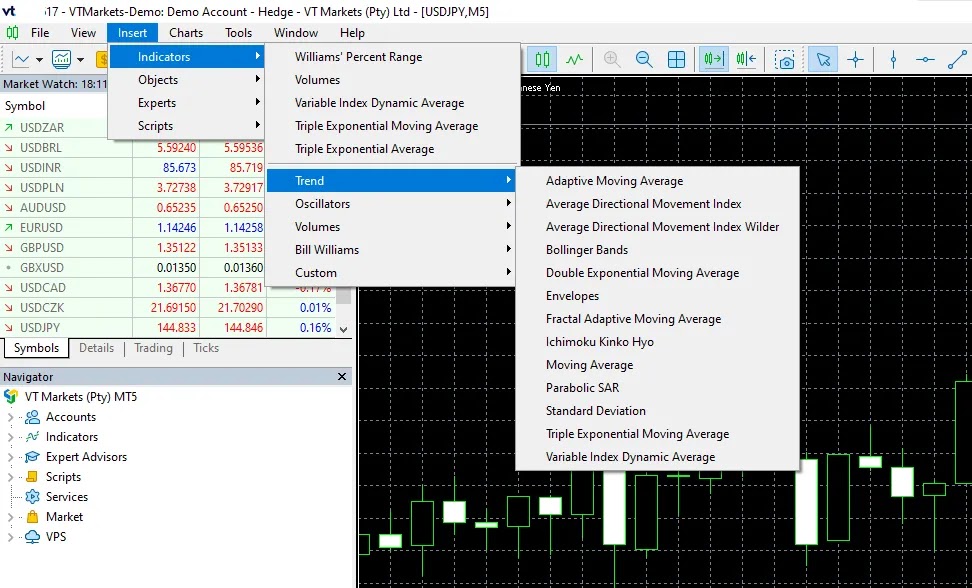

Core Technical Features

VT Markets MetaTrader 5 comes pre-loaded with expanded charting and order capabilities. These tools are essential for high-frequency traders and multi-market analysts.

MT5 Technical Enhancements

- 21 default timeframes (vs. 9 in MT4)

- Over 38 built-in technical indicators

- Depth of Market (DoM) functionality

- Multi-threaded backtesting with tick data

- Partial order filling and advanced trade execution rules

Unlike MT4, MT5 provides built-in support for Depth of Market (Level 2 quotes), allowing traders to assess liquidity before placing larger orders.

Algorithmic Trading and Strategy Tools

The platform supports MQL5-based development for advanced Expert Advisors (EAs).

Automation Infrastructure

Automation Layer | Details |

Scripting Language | MQL5 – more powerful than MQL4 |

Backtesting Support | Multi-threaded; based on real ticks |

Execution Speed | Enhanced via Equinix NY4/LD5 |

EA Hosting | Requires external VPS |

EA Marketplace | Accessible from MetaTrader platform directly |

Unlike other brokers, VT Markets does not offer a native VPS or EA library, which is an area for future improvement—especially when competing platforms already integrate social and copy-trading.

Trading Conditions and Execution

The trading environment under MT5 is built for performance:

- Spreads start from 0.0 pips (on RAW accounts)

- Leverage up to 1:500 (depending on jurisdiction)

- No dealing desk (STP execution)

- Access via Equinix NY4 and LD5 for low-latency routing

Users can open multiple trade types including stop, limit, trailing stop, and market orders with partial fill support.

Trading Conditions Summary

Feature | Condition |

Spread | From 0.0 pips |

Execution | STP – Equinix routed |

Min. Order Size | 0.01 lots |

Order Types | Market, Pending, Stop, OCO |

Account Types | RAW ECN, Standard |

These configurations match what is available in Pepperstone and BlackBull Markets, giving VT Markets a competitive edge in execution.

Summary and Use Case

The VT Markets MT5 platform enables efficient multi-asset trading with low spreads, fast execution, and high automation capability. For traders needing more than just forex—such as crypto, commodities, and share CFDs—this environment is well structured.

While it lacks social trading and native VPS, its raw performance, asset coverage, and platform stability make it a strong core terminal. Users can leverage tools like EA support, DoM data, and backtesting while executing strategies across over 1,000 assets.

Advanced users considering VT Markets MetaTrader 5 will benefit from deep liquidity and flexible account structure. For mobile-first or regional traders, VT Markets could increase competitiveness by expanding localised education and user interface support.

FAQ:

MT5 offers more instruments, extra order types, depth of market, and faster backtesting. It’s also suitable for multi-asset traders.

Visit the VT Markets platform section, select MT5, and download the installer for your device (Windows, Mac, mobile, or browser).

Yes. You can trade cryptocurrencies like BTC/USD, ETH/USD as CFDs directly in the platform.

Yes. Users can build and deploy Expert Advisors using MQL5, and run multi-threaded backtests.

Yes. Accounts are created separately, but users can operate both from the VT Markets client portal