VT Markets Minimum Deposit: Requirements, Process, and Funding Options

Before you can start trading on any live account, understanding the VT Markets Minimum Deposit is critical. The broker has specific funding thresholds depending on the type of account you choose. In this article, we examine the minimum deposit required, supported currencies, deposit channels, and related conditions. We also include practical steps to help you avoid delays and ensure that your account is activated correctly.

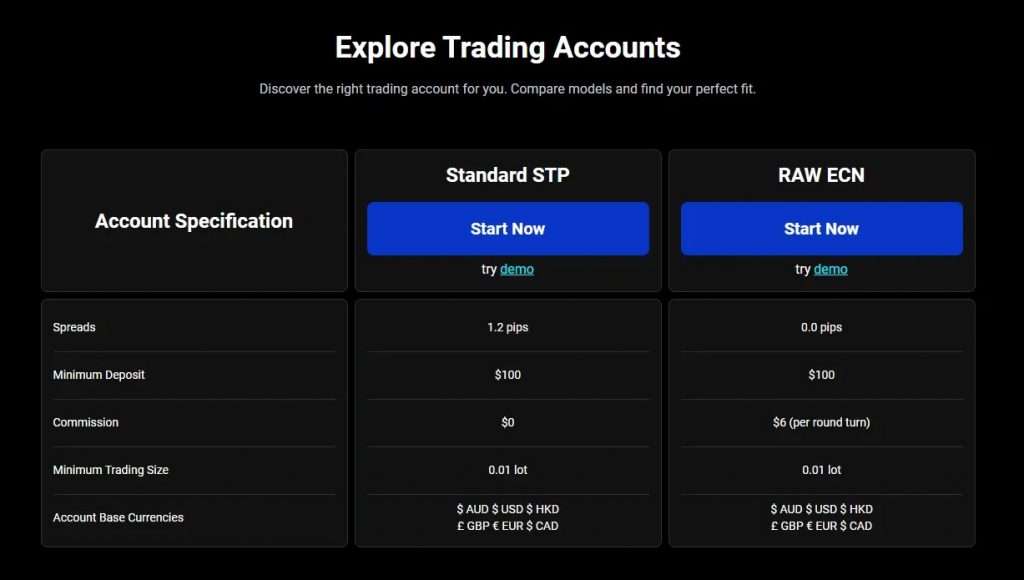

Minimum Deposit by Account Type

VT Markets offers a range of live trading accounts, each with its own deposit requirement. These requirements determine whether your account will be eligible for trading or remain in inactive status.

| Account Type | Minimum Deposit | Base Currency Options | Platform Access |

| Standard STP | $100 | USD, EUR, GBP, AUD, CAD, HKD | MT4 / MT5 |

| Raw ECN | $100 | USD, EUR, GBP, AUD, CAD, HKD | MT4 / MT5 |

| Cent Account | $50 | USD | MT5 |

| Live Account | 50 base units | Currency-specific | MT4 / MT5 |

| Demo Account | None | N/A | MT4 / MT5 |

Supported Base Currencies and Conversions

When you fund your account, the amount must match your account’s base currency. VT Markets supports the following base currencies:

- USD (United States Dollar)

- EUR (Euro)

- GBP (British Pound)

- AUD (Australian Dollar)

- CAD (Canadian Dollar)

- HKD (Hong Kong Dollar)

You cannot fund an account in one currency and trade in another without conversion. VT Markets does not automatically convert funds to your selected base currency. Depositing in the same currency as your account base avoids conversion fees and simplifies accounting.

How to Fund and Meet the Minimum Deposit

After you’ve completed registration and KYC verification, you can fund your account. The process to meet the VT Markets Minimum Deposit involves the following steps:

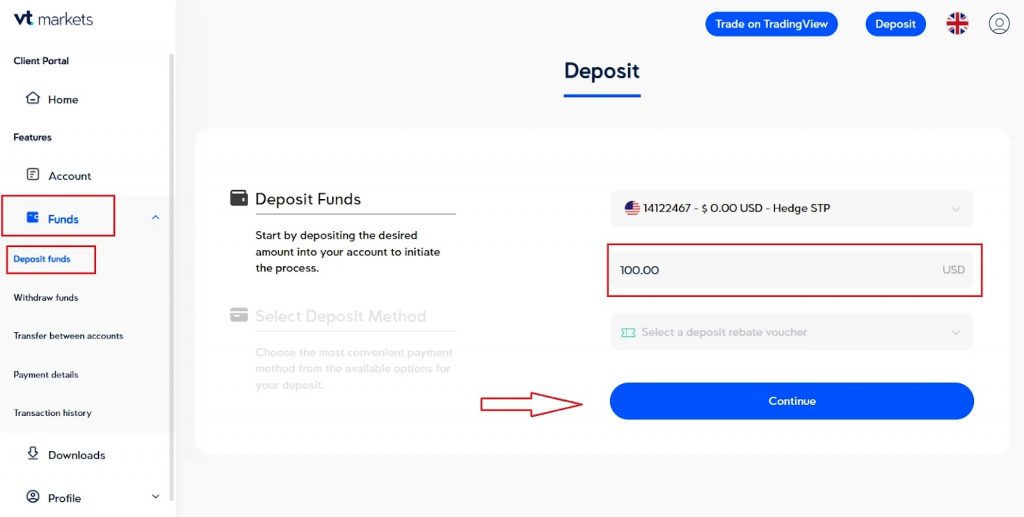

Steps to Make Your First Deposit

1. Log into your VT Markets Client Portal.

2. Navigate to the “Deposit” section in the dashboard.

3. Select the account you wish to fund.

4. Choose a payment method.

5. Enter the amount, ensuring it meets or exceeds the required minimum.

6. Confirm the transaction.

If the deposit does not meet the minimum required for your chosen account type, you will not be able to access the live markets. Funds may appear in your account, but trading access will remain restricted until the threshold is met.

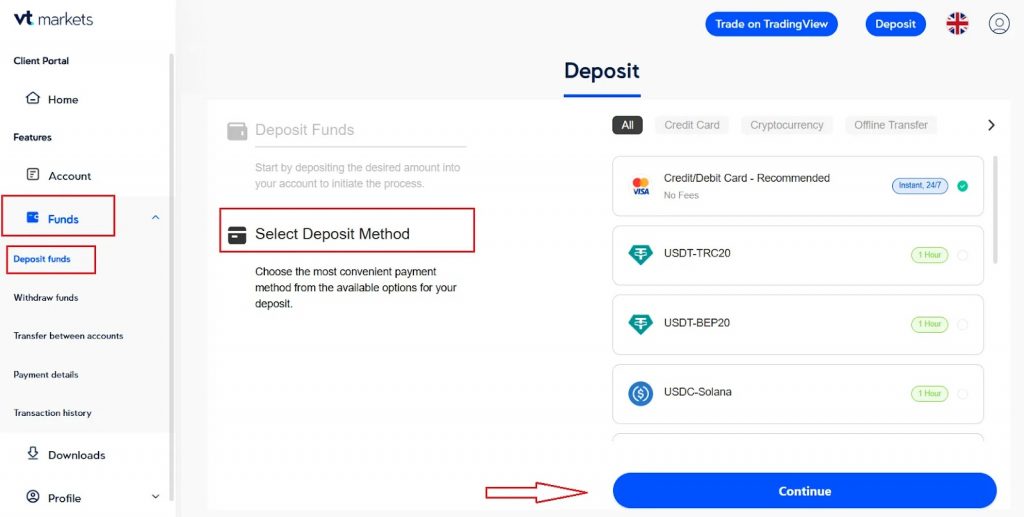

Payment Methods and Processing Times

VT Markets offers a variety of funding options. Each method has a different processing time and availability depending on your region. Accepted Funding Methods| Method | Availability | Estimated Processing Time |

| Bank Wire Transfer | Global | 2–5 business days |

| Credit/Debit Card | Global | Instant to 30 minutes |

| E-wallets (Skrill, Neteller) | Supported regions | Within 1 hour |

| Cryptocurrency | Selected regions | 1–3 hours |

Step 4: Account Selection and Activation

Following KYC approval, users select account preferences.

Account Configuration Options

Field | Options Available |

Account Type | Standard STP, Raw ECN, Cent, Swap-Free, Demo |

Trading Platform | MT4 or MT5 |

Base Currency | USD, EUR, GBP, AUD, CAD, HKD |

Leverage | Up to 1:500 |

Swap-Free Preference | Optional, manual application |

After completing the above, login credentials are emailed to the user.

Practical Scenarios Based on Funding Level

Depending on the type of trader you are, your deposit behavior may vary. Here are three common scenarios that explain how minimum deposits apply in practice:

Deposit Scenarios

- Scenario 1: New Retail Trader

You open a Standard STP account and deposit $80. You won’t gain live trading access until you deposit an additional $20 to meet the $100 minimum. - Scenario 2: Testing MT5 with Cent Account

You deposit $50 to try the Cent Account. This meets the requirement, and trading starts immediately. - Scenario 3: Wrong Base Currency

You deposit 100 GBP into a USD-based account. You may face conversion delays or additional fees until the amount is reconciled with the base requirement.

Minimum Deposit for Withdrawals

VT Markets also imposes a minimum withdrawal amount, which indirectly relates to the minimum deposit. Users must ensure their balance exceeds 40 units of their base currency to request a withdrawal. Withdrawals below this threshold will not be processed.

This policy ensures operational efficiency and minimizes small-amount transfer delays.

Key Considerations Before Making a Deposit

Before funding your account, review these operational and technical points to avoid delays or failed transactions:

Best Practices for Meeting Minimum Deposit Conditions

- Confirm your account’s base currency before funding.

- Double-check the required minimum for your account type.

- Use compatible payment methods listed in the Client Portal.

- Avoid third-party payments, as they will be rejected.

- Monitor your email for deposit confirmation within the expected time window.

Deposits that don’t follow these conditions may be rejected or delayed. VT Markets will notify you by email if a transaction needs manual review.

Summary

The VT Markets Minimum Deposit varies by account type:

- $100 for Standard STP and Raw ECN accounts

- $50 for Cent Accounts

- 50 units for general Live Account access

Supported currencies include USD, EUR, GBP, AUD, CAD, and HKD. Users must fund in the same base currency as the account to avoid delays and conversion fees. Deposits can be made via bank wire, card, e-wallet, or crypto—each with its own processing time.

Depositing less than the minimum will result in inactive trading status. Traders must verify that funds match or exceed account requirements to activate access to MT4, MT5, or the VT Markets App.

By following the structured funding process and adhering to technical limits, users can meet deposit minimums efficiently and begin trading without interruption.

FAQ:

The minimum is $100 or the equivalent in your base currency.

No. VT Markets supports only six base currencies: USD, EUR, GBP, AUD, CAD, and HKD.

No. The same account-based minimums apply to all funding methods.

Your account will remain inactive for live trading until the total deposit meets the minimum.

It depends on the payment method. E-wallets and cards are fastest, while bank wires can take several days.