VT Markets Leverage: Trading Power, Risk Exposure, and Management Features

When trading with leveraged instruments, understanding how leverage works and what it means for your capital is essential. The VT Markets Leverage offering provides flexible trading power across different asset classes. Leverage allows traders to open larger positions with less capital, increasing both profit potential and downside risk. In this article, we break down leverage limits at VT Markets, explore how it applies to different markets, review operational policies, and explain how traders can control and adjust their leverage settings. The data and descriptions here are based on official VT Markets resources.

Leverage Levels by Instrument Type

VT Markets applies different leverage caps depending on the type of financial instrument. The maximum permitted leverage on the platform varies based on asset volatility, regulatory considerations, and internal risk assessments. Leverage Limits at VT Markets| Instrument Category | Maximum Leverage | Notes |

| Forex (Major Pairs) | Up to 500:1 | Applies to pairs like EUR/USD, GBP/USD, USD/JPY |

| Gold | Up to 500:1 | Same as forex; subject to high intraday fluctuations |

| Indices & Commodities | 100:1 to 500:1 | Oil, natural gas, and global indices |

| Silver | Fixed 100:1 | No customisation available |

| US Share CFDs | Fixed 33:1 | Based on individual equity risk |

| Cryptocurrency CFDs | 100:1 – 200:1 | BTC/USD up to 100:1, ETH/USD up to 200:1 |

How Leverage Affects Margin and Trade Size

Leverage directly impacts the amount of margin required to open and hold a position. With higher leverage, the capital required per trade decreases. However, risk exposure increases proportionally.

Example Calculation:

- Trading 1 lot of EUR/USD ($100,000 notional value) with 100:1 leverage requires $1,000 in margin.

- With 500:1 leverage, the same position requires only $200 in margin.

Common Leverage Levels and Margin Requirements

- 50:1 → $2,000 per 1 standard lot

- 100:1 → $1,000 per lot

- 200:1 → $500 per lot

- 500:1 → $200 per lot

These calculations help traders plan position sizing based on their balance and leverage preference.

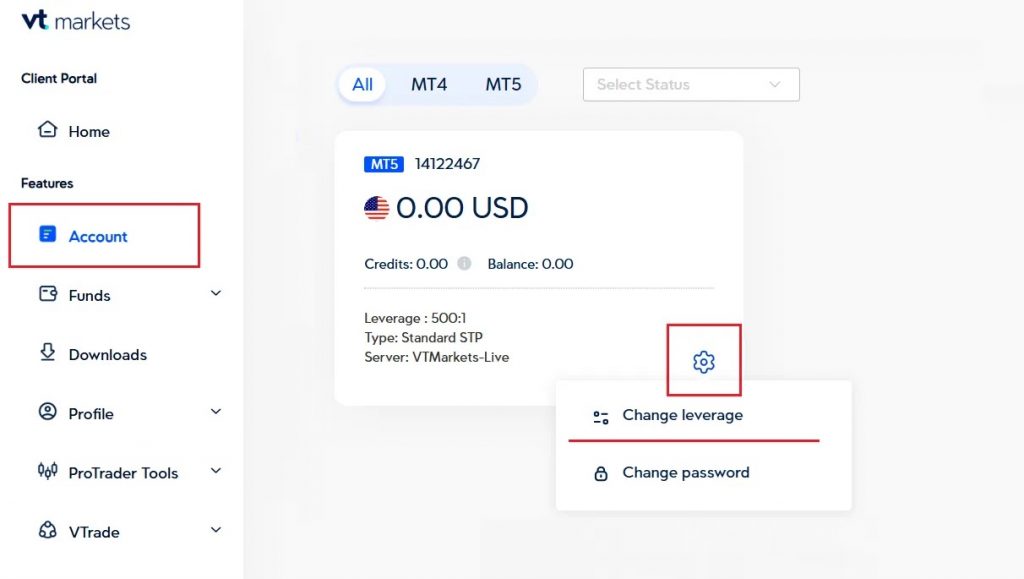

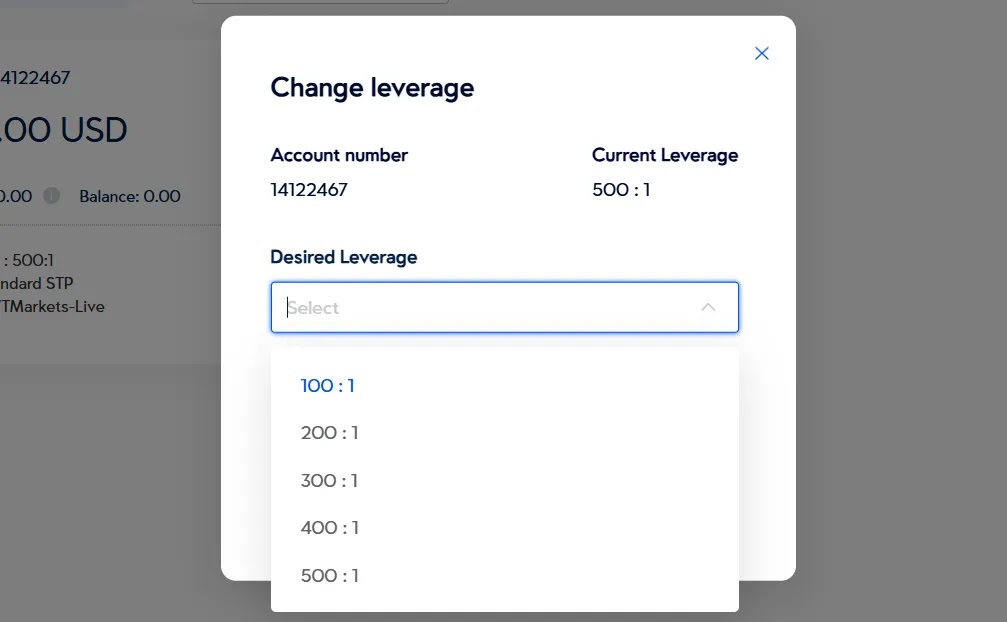

How to Adjust Leverage at VT Markets

VT Markets gives users the ability to change their account leverage directly from the Client Portal. This allows traders to match leverage settings to their strategy and risk profile.

To change your leverage:

1. Log into your VT Markets Client Portal

2. Navigate to “Accounts” and select the desired trading account

3. Locate the leverage setting and click “Edit”

Leverage changes may be subject to approval and won’t apply retroactively to open positions. Traders should close all trades before adjusting leverage to avoid margin inconsistency.

Risk Management Considerations

Leverage increases the potential return, but also the probability of rapid losses. Without proper risk controls, even a small adverse move can trigger a margin call or stop-out. Margin Risk at Different Leverage Levels| Leverage Level | Margin Required (1 lot) | Risk Exposure (per $1,000 balance) |

| 50:1 | $2,000 | Low risk, limited exposure |

| 100:1 | $1,000 | Moderate exposure |

| 200:1 | $500 | High exposure |

| 500:1 | $200 | Very high exposure |

Conditions Where Leverage May Be Changed Automatically

There are circumstances where VT Markets may override a trader’s chosen leverage setting. These include:

Situations Triggering Leverage Revisions

- High volatility periods such as market openings or geopolitical news events

- Regulatory policy updates depending on your region

- Trading cryptocurrencies where leverage caps are dynamic and product-specific

- Corporate actions or token events on crypto or equity CFDs

In such cases, the broker notifies traders via the platform or email in advance. Users must monitor their accounts during these periods to avoid unexpected margin calls.

Practical Examples of Leverage Use

To understand how leverage works in everyday trading, consider the following examples:

Scenario A: Conservative Trader (50:1)

- Balance: $5,000

- Trade: 0.5 lots EUR/USD

- Margin required: ~$500

- Objective: Minimise exposure, preserve equity

Scenario B: Aggressive Trader (500:1)

- Balance: $2,000

- Trade: 2 lots XAU/USD

- Margin required: ~$800

- Objective: Maximise short-term exposure, high risk tolerance

These scenarios illustrate the flexibility of VT Markets leverage settings in matching individual trading approaches.

Summary

The VT Markets Leverage model provides access to ratios as high as 500:1 for forex and gold, with tailored caps for other instruments. This flexibility allows traders to manage positions more efficiently and adjust exposure based on strategy.

Key takeaways:

- Leverage is account-adjustable via the Client Portal

- Instrument-specific leverage ensures risk alignment

- Traders should match leverage with risk appetite

- VT Markets may revise leverage under exceptional conditions

Leverage is a powerful tool, but it should be used with strict risk management to avoid unnecessary losses and account instability.

FAQ:

500:1 on forex and gold pairs.

Yes. Leverage can be changed in the Client Portal depending on asset class and region.

Yes. Crypto CFDs are capped at 100:1 for BTC and 200:1 for ETH.

Sometimes. Traders are notified if changes apply.

Leverage changes only apply to new positions. Open trades retain prior settings.